Comments

[deleted] t1_j7kl7dv wrote

[deleted]

Melknee09 OP t1_j7klb46 wrote

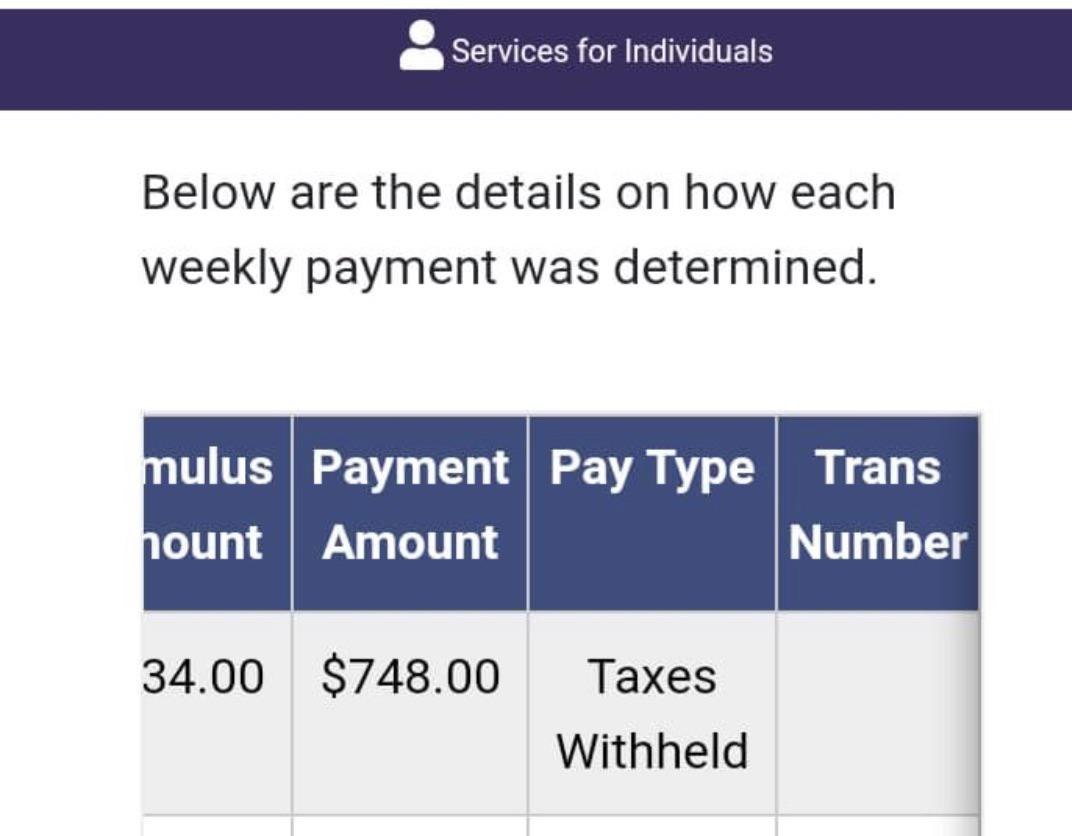

So am i just waiting on payments or am I’m not getting them? I’m sorry I’m so confused. Did they take it all for taxes.

Critical_Band5649 t1_j7kmbxw wrote

It looks like you are waiting on your payments. The first week after being eligible is a waiting period, you do not receive pay for that week. If you have been expecting payments longer than that and haven't received them, contact your state rep to get unemployment in touch with you. And continue to submit your weekly certifications in the meantime.

Melknee09 OP t1_j7kmvyu wrote

All of them say pay type “taxes withheld” i originally talked to someone in the office about a week ago when they said they everything was cleared. This claim has been open since October.

heightsdrinker t1_j7kvlvt wrote

Do you have a federal tax lien against you? Do you owe the Feds and/or State money? Do you owe back child support? All of these would be factors.

Melknee09 OP t1_j7kvvki wrote

Not that i know of i havent gotten any information like that and irs website doesn’t have me owning anything. Is there somewhere else i could look to find out?

heightsdrinker t1_j7l5vkx wrote

Contact the office again. Make sure they have your correct information. If it has been ongoing since October, and there is an error in ACH payments, they may say it’s your fault. The Taxes Withheld statement may also just mean that the 10% is withheld.

Honestly, I think some wires are getting crossed between you and the Dept. Remember to be clear and concise. If something doesn’t sound right, ask them to repeat and explain.

Critical_Band5649 t1_j7kkd35 wrote

It means they withheld federal taxes. You'll get a form next tax season that lists how much tax you paid on the unemployment income. Not everyone opts in to have tax withheld, they choose to pay that when they file their taxes. It just distinguishes between the two.