Submitted by thatdude333 t3_11n7w39 in dataisbeautiful

Comments

lpangelrob t1_jbm2lu4 wrote

I stayed behind for the tech job!

The good news is that houses are affordable. The bad news is that they don’t increase in value… at all!

DM-me-ur-tits-plz- t1_jbm2v6x wrote

Yes, a blessing and a curse! My parents plan on moving south for retirement, but don't want to stomach selling the house for less than they bought it for... They bought it in 2007!

lpangelrob t1_jbm3b0y wrote

Ah yes, that was not a great year to jump in, since that was peak-ish.

Source: bought in 2005.

DM-me-ur-tits-plz- t1_jbm3un7 wrote

I've always kept an eye on the Chicago tech sector (know a few people from college who are big on the whole "built in Chicago" train) because I feel like I'll eventually want to go back, but it feels like so much of it is Fintech which has never really appealed to me.

If my current company ever opens a Chicago office I'd probably pursue it.

lpangelrob t1_jbmajup wrote

Some of it is, but it’s really a hodgepodge. I’m in marketing tech, there’s some insurance, some food, Groupon, Uptake, consultants, and Fortune 500 companies.

None of it is either bleeding edge or hypergrowth territory, which may or may not be what the new college grads are looking for.

SaggyFrontButt2 t1_jbmpo0l wrote

This is a problem with a lot of north suburb Chicago homes. They’re already relatively expensive with high property taxes, but don’t really increase in value. Worst of both worlds

Achillies2heel t1_jbo6ca4 wrote

Rural Illinois is the most boring place in this country... Spent 20 years there growing up never going back or looking at corn again...

czyivn t1_jbpcgc9 wrote

There are an awful lot of most boring places in america. Anywhere from lubbock texas on up to rural illinois is basically the same in my mind. Flat, boring. Maybe corn, maybe wheat, maybe just grass, but boring.

proof_required t1_jbpjbm1 wrote

Is this like what they show in some of the Hollywood movies? I kind of found it calming. But yeah I can understand living there for 20 years can wear you down.

Achillies2heel t1_jbppu2s wrote

Winter is the worst because its cold and everything is just barren blowed cornstalks for 5 months

Late_Advice_9793 t1_jdq4iwr wrote

Move to Chicago then

Achillies2heel t1_jdqe9ap wrote

Id rather not get shot

I_Own_A_Bidet t1_jbp2t0s wrote

So much fucking this. Fuck Illinois

Bulbchanger5000 t1_jbmxdyu wrote

I feel this. I don’t go on FB often but I’ve seen how people I went to HS with in central Ohio were able to buy houses in that area years ago in their mid 20s. I’m 30 now and it could take my partner and I another 10 years to afford even smallest of houses in the SF Bay Area where I currently live if we’re lucky. We’re seriously considering moving to the Midwest at this point. Wouldn’t trade getting to spend my 20s here in California for much though. It’s been a lot of fun, but it seems like it has become impossible for a lot of normal people to ever settle down here.

Edmeyers01 t1_jbplfse wrote

We're putting offers in on houses in Pittsburgh. We're looking in the best neighborhoods and a nice 2 bedroom 1 bath house is like 275K and whole foods is 5 minutes away. I love SD, but for us it's just not worth it anymore. I'm afraid we'll keep getting priced out of other markets too if we wait.

Ok_Confusion_1777 t1_jbql7w5 wrote

Which neighborhoods may I ask?

Edmeyers01 t1_jbqoep5 wrote

Yeah, of course! Highland Park.

Slytherin77777 t1_jbp14vb wrote

Ya but like do you wanna move back to Illinois lol

[deleted] t1_jbsn44r wrote

To be fair, you couldn't pay me enough to live in most of those top 10 towns in IL, and I'm from there.

Late_Advice_9793 t1_jdq4mh5 wrote

What about the Chicago area

CookieEnabled t1_jbm3fv8 wrote

Post this on r/FirstTimeHomeBuyer and see what happens

TheOnlyBasedRedditor t1_jbna2ub wrote

I wonder, what would happen?

coolo04 t1_jbno5xs wrote

People would get mad because they live in the red/yellow cities

captainpicard6912 t1_jbq3l9p wrote

Yeah, and then exclaim that it's a "human right" to live wherever you want, for as long as you want, for whatever price you want.

extreme_imbecile t1_jbrxblv wrote

Yeah haha. Teachers and bank tellers have no right to live within an hour of where they work but I have a right to own five rentals because the market says so haha. Wait what the fuck why are schools closed on Fridays and my favorite restaurants shutting down?!

26Kermy t1_jbny141 wrote

Everyone will move to rural Illinois?

ReasonablyPricedBird t1_jbpt7ne wrote

You might want to check out their propery taxes before you make that move.

Spence97 t1_jbqicci wrote

Property taxes often are over 3% when I look around online, casually. I’m not an expert but they’re insanely high when I do check listings there. I gather they must have a crazy amount of layers in their state and local governments.

Also, at the same time, I often see houses assessed for way over what they’d sell for. I’ve seen some assessed up to 50% over current list price, where the house had been sitting for sale for months at that list price.

DamonFields t1_jbmov1d wrote

Places people want to live in cost more.

scoobertsonville t1_jbmy82g wrote

This, I think the key is that when you are ready to buy a house search for a mid sized city (or as they say in China, second tier) the housing market is basically a bidding war for the best location in cities and given the us population is increasing by 1-1.5 million a year supply is always going to constrain in the massive cities, so mid tier expansion keeps everyone with the American dream imo. Remote work helps with this.

Electrical-Song19 t1_jbr9jfl wrote

Yeah despite these metrics there, San Diego will always be a very desirable place to live in with plenty of people wanting to move in for the people that want to move out.

​

So whenever you read about the waning demographics of the USA in the coming decade or two, realize that it's going to hit the most in cities that no one wants to live in. And places like San Diego are not going to be affected by that.

Iluvteak t1_jbye2lz wrote

It’s funny that the 1 million population increase per year is similar to the number of illegals that breach the border every year. Shut the border … fix the real estate market !

PYHProtectYourHoles t1_jbmufrp wrote

Colorado lol.

Everyone moving there rn is gonna move back in ~4 years cuz they can’t actually own a home unless you’re a rich Californian

redundant_ransomware t1_jbn3848 wrote

Also there are the wifi and bottled water issues

[deleted] t1_jbn84zt wrote

[removed]

gefahr t1_jbpv6hg wrote

the what? (genuine question)

ShitholeWorld t1_jbq4ty7 wrote

Reference to a South Park episode. S25-E3

/La Croix!

gefahr t1_jbq4vht wrote

Ah thank you.

Mackinnon29E t1_jbp3fea wrote

Yeah everyone moving to Colorado is keeping wages down for themselves and everyone else.

Sp3cialbrownie t1_jbqkesi wrote

More people moved out of Colorado than in to Colorado last year. Hopefully that continues.

MotivatingElectrons t1_jbqvjxf wrote

I believe this is not accurate -- per Denver Post, the net migration to CO has been positive since the early 90's.

​

Source: https://www.denverpost.com/2023/01/24/colorado-population-growth-slowed-2021/

Sp3cialbrownie t1_jc2ia6z wrote

Per moving companies statistics, which is a good, non government indicator, Colorado had more people move out of state than in to the state: https://www.unitedvanlines.com/newsroom/movers-study-2022

Also, the article you shared validated that demographics have hit a wall and will continue to decline, thanks for sharing.

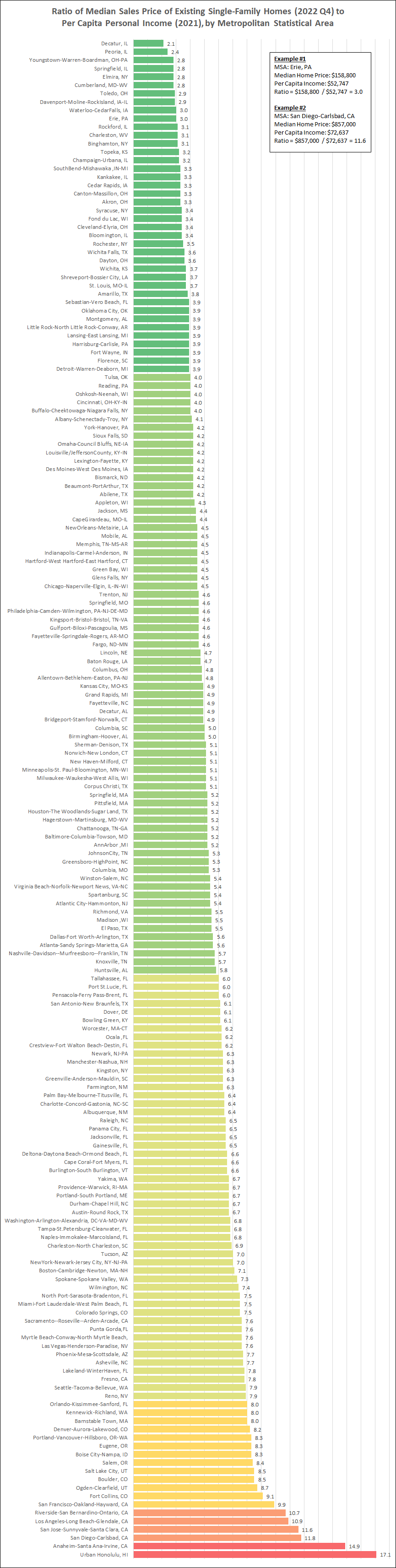

thatdude333 OP t1_jblvfte wrote

Citations:

National Association of Realtors / Median Sales Price of Existing Single-Family Homes for Metropolitan Areas (2022 Q4):

US Bureau of Economic Analysis / Per Capita Personal Income (2021):

https://www.bea.gov/data/income-saving/personal-income-county-metro-and-other-areas

What are Metropolitan Statistical Areas?

https://en.wikipedia.org/wiki/Metropolitan_statistical_area

The Metropolitan Statistical Areas listed on the chart are the ones I could match up Median Home Prices from the National Association of Realtors and Per Capita Income from the US Bureau of Economic Analysis to calculate a ratio from. Out of 384 total Metropolitan Statistical Areas, this chart shows 182 of them.

The Numbers:

Metro Stat Area - Median House Price - Per Capita Income - Ratio

- Abilene, TX - $234.9k - $55.6k - 4.2

- Akron, OH - $192.3k - $58.7k - 3.3

- Albany-Schenectady-Troy, NY - $275.9k - $67.8k - 4.1

- Albuquerque, NM - $336.5k - $52.3k - 6.4

- Allentown-Bethlehem-Easton, PA-NJ - $299.8k - $62.6k - 4.8

- Amarillo, TX - $214.3k - $56.2k - 3.8

- Anaheim-Santa Ana-Irvine, CA - $1132k - $75.8k - 14.9

- AnnArbor ,MI - $354.6k - $68.7k - 5.2

- Appleton, WI - $253.6k - $58.3k - 4.3

- Asheville, NC - $420k - $54.8k - 7.7

- Atlanta-Sandy Springs-Marietta, GA - $353.3k - $63.2k - 5.6

- Atlantic City-Hammonton, NJ - $312.4k - $58.3k - 5.4

- Austin-Round Rock, TX - $478.9k - $71.4k - 6.7

- Baltimore-Columbia-Towson, MD - $363.5k - $70.5k - 5.2

- Barnstable Town, MA - $668.1k - $83.2k - 8

- Baton Rouge, LA - $267.1k - $56.4k - 4.7

- Beaumont-PortArthur, TX - $207.3k - $49k - 4.2

- Binghamton, NY - $156.7k - $51.3k - 3.1

- Birmingham-Hoover, AL - $295.7k - $59.1k - 5

- Bismarck, ND - $266.3k - $64.1k - 4.2

- Bloomington, IL - $199.7k - $58.5k - 3.4

- Boise City-Nampa, ID - $457.8k - $55.5k - 8.3

- Boston-Cambridge-Newton, MA-NH - $657.9k - $92.3k - 7.1

- Boulder, CO - $759.5k - $89.6k - 8.5

- Bowling Green, KY - $262.8k - $43.3k - 6.1

- Bridgeport-Stamford-Norwalk, CT - $621.1k - $127.4k - 4.9

- Buffalo-Cheektowaga-Niagara Falls, NY - $227.8k - $56.8k - 4

- Burlington-South Burlington, VT - $430.5k - $65.1k - 6.6

- Canton-Massillon, OH - $169.6k - $52.2k - 3.3

- Cape Coral-Fort Myers, FL - $414.3k - $62.9k - 6.6

- CapeGirardeau, MO-IL - $211.1k - $48.4k - 4.4

- Cedar Rapids, IA - $194.3k - $59.1k - 3.3

- Champaign-Urbana, IL - $175.5k - $55.3k - 3.2

- Charleston, WV - $161.3k - $51.6k - 3.1

- Charleston-North Charleston, SC - $416.7k - $60.8k - 6.9

- Charlotte-Concord-Gastonia, NC-SC - $395.5k - $62.1k - 6.4

- Chattanooga, TN-GA - $279.6k - $53.9k - 5.2

- Chicago-Naperville-Elgin, IL-IN-WI - $323.2k - $72k - 4.5

- Cincinnati, OH-KY-IN - $255.3k - $63.1k - 4

- Cleveland-Elyria, OH - $208.7k - $61.9k - 3.4

- Colorado Springs, CO - $443.4k - $58.7k - 7.5

- Columbia, MO - $282.6k - $53.6k - 5.3

- Columbia, SC - $264k - $53.3k - 5

- Columbus, OH - $286.7k - $59.9k - 4.8

- Corpus Christi, TX - $268.2k - $52.6k - 5.1

- Crestview-Fort Walton Beach-Destin, FL - $403.7k - $64.7k - 6.2

- Cumberland, MD-WV - $132.3k - $47.6k - 2.8

- Dallas-Fort Worth-Arlington, TX - $375k - $66.7k - 5.6

- Davenport-Moline-RockIsland, IA-IL - $162.6k - $56.2k - 2.9

- Dayton, OH - $200.7k - $55.6k - 3.6

- Decatur, AL - $226.2k - $46.5k - 4.9

- Decatur, IL - $119.2k - $56.5k - 2.1

- Deltona-Daytona Beach-Ormond Beach, FL - $353.8k - $53.6k - 6.6

- Denver-Aurora-Lakewood, CO - $640k - $78.2k - 8.2

- Des Moines-West Des Moines, IA - $261k - $61.8k - 4.2

- Detroit-Warren-Deaborn, MI - $237k - $61k - 3.9

- Dover, DE - $308.1k - $50.4k - 6.1

- Durham-Chapel Hill, NC - $425.6k - $63.4k - 6.7

- El Paso, TX - $244.5k - $44.1k - 5.5

- Elmira, NY - $148.9k - $52.4k - 2.8

- Erie, PA - $158.8k - $52.7k - 3

- Eugene, OR - $459.5k - $55.1k - 8.3

- Fargo, ND-MN - $285.9k - $62k - 4.6

- Farmington, NM - $261.2k - $41.7k - 6.3

- Fayetteville, NC - $220.9k - $45.5k - 4.9

- Fayetteville-Springdale-Rogers, AR-MO - $323.5k - $70.6k - 4.6

- Florence, SC - $195.7k - $50.4k - 3.9

- Fond du Lac, WI - $189.2k - $56.4k - 3.4

- Fort Collins, CO - $585.3k - $64.3k - 9.1

- Fort Wayne, IN - $215.5k - $54.6k - 3.9

- Fresno, CA - $399k - $51.4k - 7.8

- Gainesville, FL - $330k - $50.6k - 6.5

- Glens Falls, NY - $252.4k - $56k - 4.5

- Grand Rapids, MI - $284.5k - $57.7k - 4.9

- Green Bay, WI - $260k - $58.2k - 4.5

- Greensboro-HighPoint, NC - $276.1k - $51.9k - 5.3

- Greenville-Anderson-Mauldin, SC - $318.8k - $50.9k - 6.3

- Gulfport-Biloxi-Pascagoulia, MS - $205.7k - $44.5k - 4.6

- Hagerstown-Martinsburg, MD-WV - $266.5k - $51.1k - 5.2

- Harrisburg-Carlisle, PA - $237k - $60.5k - 3.9

- Hartford-West Hartford-East Hartford, CT - $318.2k - $70k - 4.5

- Houston-The Woodlands-Sugar Land, TX - $337.9k - $64.8k - 5.2

- Huntsville, AL - $334.8k - $57.8k - 5.8

- Indianapolis-Carmel-Anderson, IN - $297.2k - $65.8k - 4.5

- Jackson, MS - $227.5k - $51.4k - 4.4

- Jacksonville, FL - $386k - $59.3k - 6.5

- JohnsonCity, TN - $254k - $48.3k - 5.3

- Kankakee, IL - $177.4k - $53.2k - 3.3

- Kansas City, MO-KS - $298.2k - $61.4k - 4.9

- Kennewick-Richland, WA - $417k - $52.1k - 8

- Kingsport-Bristol-Bristol, TN-VA - $218.3k - $47.3k - 4.6

- Kingston, NY - $381.3k - $60.6k - 6.3

- Knoxville, TN - $318.7k - $55.8k - 5.7

- Lakeland-WinterHaven, FL - $338.3k - $43.6k - 7.8

- Lansing-East Lansing, MI - $195.6k - $50.3k - 3.9

- Las Vegas-Henderson-Paradise, NV - $441.3k - $58.3k - 7.6

- Lexington-Fayette, KY - $240k - $57.5k - 4.2

- Lincoln, NE - $270k - $56.9k - 4.7

- Little Rock-North Little Rock-Conway, AR - $204.8k - $53.2k - 3.9

- Los Angeles-Long Beach-Glendale, CA - $829.1k - $75.8k - 10.9

- Louisville/JeffersonCounty, KY-IN - $251.2k - $59.4k - 4.2

- Madison ,WI - $380k - $69.1k - 5.5

- Manchester-Nashua, NH - $454.1k - $71.8k - 6.3

- Memphis, TN-MS-AR - $254k - $56.6k - 4.5

- Miami-Fort Lauderdale-West Palm Beach, FL - $550k - $73.5k - 7.5

- Milwaukee-Waukesha-West Allis, WI - $335k - $65.8k - 5.1

- Minneapolis-St. Paul-Bloomington, MN-WI - $365.6k - $71.9k - 5.1

- Mobile, AL - $207.5k - $46.4k - 4.5

- Montgomery, AL - $191.2k - $49.3k - 3.9

- Myrtle Beach-Conway-North Myrtle Beach, SC- $373.5k - $49.2k - 7.6

- Naples-Immokalee-MarcoIsland, FL - $802.5k - $118k - 6.8

- Nashville-Davidson--Murfreesboro--Franklin, TN - $400.1k - $70k - 5.7

- New Haven-Milford, CT - $329.6k - $64.6k - 5.1

- Newark, NJ-PA - $538.5k - $85.1k - 6.3

- NewOrleans-Metairie, LA - $275.9k - $61.3k - 4.5

- NewYork-Newark-Jersey City, NY-NJ-PA - $594.3k - $85.1k - 7

- North Port-Sarasota-Bradenton, FL - $520k - $69.4k - 7.5

- Norwich-New London, CT - $322.6k - $63.9k - 5.1

- Ocala ,FL - $280k - $45.2k - 6.2

- Ogden-Clearfield, UT - $453.5k - $52.3k - 8.7

- Oklahoma City, OK - $222.2k - $57.2k - 3.9

- Omaha-Council Bluffs, NE-IA - $267.2k - $64.2k - 4.2

- Orlando-Kissimmee-Sanford, FL - $422.7k - $53.1k - 8

- Oshkosh-Neenah, WI - $220.7k - $55.2k - 4

- Palm Bay-Melbourne-Titusville, FL - $355k - $55.5k - 6.4

- Panama City, FL - $350.3k - $54k - 6.5

- Pensacola-Ferry Pass-Brent, FL - $316.3k - $52.5k - 6

- Peoria, IL - $133.6k - $55.8k - 2.4

- Philadelphia-Camden-Wilmington, PA-NJ-DE-MD - $329.5k - $72.4k - 4.6

- Phoenix-Mesa-Scottsdale, AZ - $450.4k - $58.3k - 7.7

- Pittsfield, MA - $335.7k - $65.1k - 5.2

- Port St.Lucie, FL - $399.5k - $66.6k - 6

- Portland-South Portland, ME - $460.2k - $68.6k - 6.7

- Portland-Vancouver-Hillsboro, OR-WA - $567.5k - $68.4k - 8.3

- Providence-Warwick, RI-MA - $431.7k - $64.6k - 6.7

- Punta Gorda,FL - $392.8k - $51.7k - 7.6

- Raleigh, NC - $431k - $66.4k - 6.5

- Reading, PA - $233.7k - $58k - 4

- Reno, NV - $562.1k - $71.5k - 7.9

- Richmond, VA - $365k - $65.8k - 5.5

- Riverside-San Bernardino-Ontario, CA - $540k - $50.4k - 10.7

- Rochester, NY - $202.7k - $58.5k - 3.5

- Rockford, IL - $161k - $51.1k - 3.1

- Sacramento--Roseville--Arden-Arcade, CA - $500k - $66k - 7.6

- Salem, OR - $443.6k - $53k - 8.4

- Salt Lake City, UT - $524.8k - $61.6k - 8.5

- San Antonio-New Braunfels, TX - $329.8k - $53.6k - 6.1

- San Diego-Carlsbad, CA - $857k - $72.6k - 11.8

- San Francisco-Oakland-Hayward, CA - $1230k - $123.7k - 9.9

- San Jose-Sunnyvale-Santa Clara, CA - $1577.5k - $136.3k - 11.6

- Seattle-Tacoma-Bellevue, WA - $708.9k - $89.3k - 7.9

- Sebastian-Vero Beach, FL - $366.8k - $95.1k - 3.9

- Sherman-Denison, TX - $267.3k - $52.1k - 5.1

- Shreveport-Bossier City, LA - $206.3k - $55.2k - 3.7

- Sioux Falls, SD - $298.9k - $71.6k - 4.2

- SouthBend-Mishawaka ,IN-MI - $185.6k - $56.1k - 3.3

- Spartanburg, SC - $275.7k - $50.6k - 5.4

- Spokane-Spokane Valley, WA - $389.4k - $53.3k - 7.3

- Springfield, IL - $162.4k - $57.1k - 2.8

- Springfield, MA - $318.6k - $61.5k - 5.2

- Springfield, MO - $224.1k - $48.7k - 4.6

- St. Louis, MO-IL - $239k - $64.8k - 3.7

- Syracuse, NY - $197.9k - $58.1k - 3.4

- Tallahassee, FL - $315k - $52.3k - 6

- Tampa-St.Petersburg-Clearwater, FL - $399k - $58.3k - 6.8

- Toledo, OH - $159.3k - $54.4k - 2.9

- Topeka, KS - $171.5k - $53.7k - 3.2

- Trenton, NJ - $357.8k - $77.9k - 4.6

- Tucson, AZ - $368.2k - $52.9k - 7

- Tulsa, OK - $239.3k - $59.9k - 4

- Urban Honolulu, HI - $1090.2k - $63.9k - 17.1

- Virginia Beach-Norfolk-Newport News, VA-NC - $305.4k - $56.7k - 5.4

- Washington-Arlington-Alexandria, DC-VA-MD-WV - $550.1k - $80.8k - 6.8

- Waterloo-CedarFalls, IA - $161.3k - $53.6k - 3

- Wichita Falls, TX - $181.6k - $50.9k - 3.6

- Wichita, KS - $210.1k - $56.3k - 3.7

- Wilmington, NC - $414.8k - $55.8k - 7.4

- Winston-Salem, NC - $285.2k - $53.2k - 5.4

- Worcester, MA-CT - $398k - $64.5k - 6.2

- Yakima, WA - $341.3k - $50.9k - 6.7

- York-Hanover, PA - $241.1k - $57.9k - 4.2

- Youngstown-Warren-Boardman, OH-PA - $135.5k - $48.9k - 2.8

FahkDizchit t1_jboc4pb wrote

People in the VA suburbs of DC get paid.

ElvisDumbledore t1_jbqkcdz wrote

; delimited for spreadsheets

Abilene;TX;$234.9k;$55.6k;4.2

Akron;OH;$192.3k;$58.7k;3.3

Albany-Schenectady-Troy;NY;$275.9k;$67.8k;4.1

Albuquerque;NM;$336.5k;$52.3k;6.4

Allentown-Bethlehem-Easton;PA-NJ;$299.8k;$62.6k;4.8

Amarillo;TX;$214.3k;$56.2k;3.8

Anaheim-Santa Ana-Irvine;CA;$1132k;$75.8k;14.9

AnnArbor;MI;$354.6k;$68.7k;5.2

Appleton;WI;$253.6k;$58.3k;4.3

Asheville;NC;$420k;$54.8k;7.7

Atlanta-Sandy Springs-Marietta;GA;$353.3k;$63.2k;5.6

Atlantic City-Hammonton;NJ;$312.4k;$58.3k;5.4

Austin-Round Rock;TX;$478.9k;$71.4k;6.7

Baltimore-Columbia-Towson;MD;$363.5k;$70.5k;5.2

Barnstable Town;MA;$668.1k;$83.2k;8

Baton Rouge;LA;$267.1k;$56.4k;4.7

Beaumont-PortArthur;TX;$207.3k;$49k;4.2

Binghamton;NY;$156.7k;$51.3k;3.1

Birmingham-Hoover;AL;$295.7k;$59.1k;5

Bismarck;ND;$266.3k;$64.1k;4.2

Bloomington;IL;$199.7k;$58.5k;3.4

Boise City-Nampa;ID;$457.8k;$55.5k;8.3

Boston-Cambridge-Newton;MA-NH;$657.9k;$92.3k;7.1

Boulder;CO;$759.5k;$89.6k;8.5

Bowling Green;KY;$262.8k;$43.3k;6.1

Bridgeport-Stamford-Norwalk;CT;$621.1k;$127.4k;4.9

Buffalo-Cheektowaga-Niagara Falls;NY;$227.8k;$56.8k;4

Burlington-South Burlington;VT;$430.5k;$65.1k;6.6

Canton-Massillon;OH;$169.6k;$52.2k;3.3

Cape Coral-Fort Myers;FL;$414.3k;$62.9k;6.6

CapeGirardeau;MO-IL;$211.1k;$48.4k;4.4

Cedar Rapids;IA;$194.3k;$59.1k;3.3

Champaign-Urbana;IL;$175.5k;$55.3k;3.2

Charleston;WV;$161.3k;$51.6k;3.1

Charleston-North Charleston;SC;$416.7k;$60.8k;6.9

Charlotte-Concord-Gastonia;NC-SC;$395.5k;$62.1k;6.4

Chattanooga;TN-GA;$279.6k;$53.9k;5.2

Chicago-Naperville-Elgin;IL-IN-WI;$323.2k;$72k;4.5

Cincinnati;OH-KY-IN;$255.3k;$63.1k;4

Cleveland-Elyria;OH;$208.7k;$61.9k;3.4

Colorado Springs;CO;$443.4k;$58.7k;7.5

Columbia;MO;$282.6k;$53.6k;5.3

Columbia;SC;$264k;$53.3k;5

Columbus;OH;$286.7k;$59.9k;4.8

Corpus Christi;TX;$268.2k;$52.6k;5.1

Crestview-Fort Walton Beach-Destin;FL;$403.7k;$64.7k;6.2

Cumberland;MD-WV;$132.3k;$47.6k;2.8

Dallas-Fort Worth-Arlington;TX;$375k;$66.7k;5.6

Davenport-Moline-RockIsland;IA-IL;$162.6k;$56.2k;2.9

Dayton;OH;$200.7k;$55.6k;3.6

Decatur;AL;$226.2k;$46.5k;4.9

Decatur;IL;$119.2k;$56.5k;2.1

Deltona-Daytona Beach-Ormond Beach;FL;$353.8k;$53.6k;6.6

Denver-Aurora-Lakewood;CO;$640k;$78.2k;8.2

Des Moines-West Des Moines;IA;$261k;$61.8k;4.2

Detroit-Warren-Deaborn;MI;$237k;$61k;3.9

Dover;DE;$308.1k;$50.4k;6.1

Durham-Chapel Hill;NC;$425.6k;$63.4k;6.7

El Paso;TX;$244.5k;$44.1k;5.5

Elmira;NY;$148.9k;$52.4k;2.8

Erie;PA;$158.8k;$52.7k;3

Eugene;OR;$459.5k;$55.1k;8.3

Fargo;ND-MN;$285.9k;$62k;4.6

Farmington;NM;$261.2k;$41.7k;6.3

Fayetteville;NC;$220.9k;$45.5k;4.9

Fayetteville-Springdale-Rogers;AR-MO;$323.5k;$70.6k;4.6

Florence;SC;$195.7k;$50.4k;3.9

Fond du Lac;WI;$189.2k;$56.4k;3.4

Fort Collins;CO;$585.3k;$64.3k;9.1

Fort Wayne;IN;$215.5k;$54.6k;3.9

Fresno;CA;$399k;$51.4k;7.8

Gainesville;FL;$330k;$50.6k;6.5

Glens Falls;NY;$252.4k;$56k;4.5

Grand Rapids;MI;$284.5k;$57.7k;4.9

Green Bay;WI;$260k;$58.2k;4.5

Greensboro-HighPoint;NC;$276.1k;$51.9k;5.3

Greenville-Anderson-Mauldin;SC;$318.8k;$50.9k;6.3

Gulfport-Biloxi-Pascagoulia;MS;$205.7k;$44.5k;4.6

Hagerstown-Martinsburg;MD-WV;$266.5k;$51.1k;5.2

Harrisburg-Carlisle;PA;$237k;$60.5k;3.9

Hartford-West Hartford-East Hartford;CT;$318.2k;$70k;4.5

Houston-The Woodlands-Sugar Land;TX;$337.9k;$64.8k;5.2

Huntsville;AL;$334.8k;$57.8k;5.8

Indianapolis-Carmel-Anderson;IN;$297.2k;$65.8k;4.5

Jackson;MS;$227.5k;$51.4k;4.4

Jacksonville;FL;$386k;$59.3k;6.5

JohnsonCity;TN;$254k;$48.3k;5.3

Kankakee;IL;$177.4k;$53.2k;3.3

Kansas City;MO-KS;$298.2k;$61.4k;4.9

Kennewick-Richland;WA;$417k;$52.1k;8

Kingsport-Bristol-Bristol;TN-VA;$218.3k;$47.3k;4.6

Kingston;NY;$381.3k;$60.6k;6.3

Knoxville;TN;$318.7k;$55.8k;5.7

Lakeland-WinterHaven;FL;$338.3k;$43.6k;7.8

Lansing-East Lansing;MI;$195.6k;$50.3k;3.9

Las Vegas-Henderson-Paradise;NV;$441.3k;$58.3k;7.6

Lexington-Fayette;KY;$240k;$57.5k;4.2

Lincoln;NE;$270k;$56.9k;4.7

Little Rock-North Little Rock-Conway;AR;$204.8k;$53.2k;3.9

Los Angeles-Long Beach-Glendale;CA;$829.1k;$75.8k;10.9

Louisville/JeffersonCounty;KY-IN;$251.2k;$59.4k;4.2

Madison;WI;$380k;$69.1k;5.5

Manchester-Nashua;NH;$454.1k;$71.8k;6.3

Memphis;TN-MS-AR;$254k;$56.6k;4.5

Miami-Fort Lauderdale-West Palm Beach;FL;$550k;$73.5k;7.5

Milwaukee-Waukesha-West Allis;WI;$335k;$65.8k;5.1

Minneapolis-St. Paul-Bloomington;MN-WI;$365.6k;$71.9k;5.1

Mobile;AL;$207.5k;$46.4k;4.5

Montgomery;AL;$191.2k;$49.3k;3.9

Myrtle Beach-Conway-North Myrtle Beach;SC;$373.5k;$49.2k;7.6

Naples-Immokalee-MarcoIsland;FL;$802.5k;$118k;6.8

Nashville-Davidson--Murfreesboro--Franklin;TN;$400.1k;$70k;5.7

New Haven-Milford;CT;$329.6k;$64.6k;5.1

Newark;NJ-PA;$538.5k;$85.1k;6.3

NewOrleans-Metairie;LA;$275.9k;$61.3k;4.5

NewYork-Newark-Jersey City;NY-NJ-PA;$594.3k;$85.1k;7

North Port-Sarasota-Bradenton;FL;$520k;$69.4k;7.5

Norwich-New London;CT;$322.6k;$63.9k;5.1

Ocala;FL;$280k;$45.2k;6.2

Ogden-Clearfield;UT;$453.5k;$52.3k;8.7

Oklahoma City;OK;$222.2k;$57.2k;3.9

Omaha-Council Bluffs;NE-IA;$267.2k;$64.2k;4.2

Orlando-Kissimmee-Sanford;FL;$422.7k;$53.1k;8

Oshkosh-Neenah;WI;$220.7k;$55.2k;4

Palm Bay-Melbourne-Titusville;FL;$355k;$55.5k;6.4

Panama City;FL;$350.3k;$54k;6.5

Pensacola-Ferry Pass-Brent;FL;$316.3k;$52.5k;6

Peoria;IL;$133.6k;$55.8k;2.4

Philadelphia-Camden-Wilmington;PA-NJ-DE-MD;$329.5k;$72.4k;4.6

Phoenix-Mesa-Scottsdale;AZ;$450.4k;$58.3k;7.7

Pittsfield;MA;$335.7k;$65.1k;5.2

Port St.Lucie;FL;$399.5k;$66.6k;6

Portland-South Portland;ME;$460.2k;$68.6k;6.7

Portland-Vancouver-Hillsboro;OR-WA;$567.5k;$68.4k;8.3

Providence-Warwick;RI-MA;$431.7k;$64.6k;6.7

Punta Gorda;FL;$392.8k;$51.7k;7.6

Raleigh;NC;$431k;$66.4k;6.5

Reading;PA;$233.7k;$58k;4

Reno;NV;$562.1k;$71.5k;7.9

Richmond;VA;$365k;$65.8k;5.5

Riverside-San Bernardino-Ontario;CA;$540k;$50.4k;10.7

Rochester;NY;$202.7k;$58.5k;3.5

Rockford;IL;$161k;$51.1k;3.1

Sacramento--Roseville--Arden-Arcade;CA;$500k;$66k;7.6

Salem;OR;$443.6k;$53k;8.4

Salt Lake City;UT;$524.8k;$61.6k;8.5

San Antonio-New Braunfels;TX;$329.8k;$53.6k;6.1

San Diego-Carlsbad;CA;$857k;$72.6k;11.8

San Francisco-Oakland-Hayward;CA;$1230k;$123.7k;9.9

San Jose-Sunnyvale-Santa Clara;CA;$1577.5k;$136.3k;11.6

Seattle-Tacoma-Bellevue;WA;$708.9k;$89.3k;7.9

Sebastian-Vero Beach;FL;$366.8k;$95.1k;3.9

Sherman-Denison;TX;$267.3k;$52.1k;5.1

Shreveport-Bossier City;LA;$206.3k;$55.2k;3.7

Sioux Falls;SD;$298.9k;$71.6k;4.2

SouthBend-Mishawaka;IN-MI;$185.6k;$56.1k;3.3

Spartanburg;SC;$275.7k;$50.6k;5.4

Spokane-Spokane Valley;WA;$389.4k;$53.3k;7.3

Springfield;IL;$162.4k;$57.1k;2.8

Springfield;MA;$318.6k;$61.5k;5.2

Springfield;MO;$224.1k;$48.7k;4.6

St. Louis;MO-IL;$239k;$64.8k;3.7

Syracuse;NY;$197.9k;$58.1k;3.4

Tallahassee;FL;$315k;$52.3k;6

Tampa-St.Petersburg-Clearwater;FL;$399k;$58.3k;6.8

Toledo;OH;$159.3k;$54.4k;2.9

Topeka;KS;$171.5k;$53.7k;3.2

Trenton;NJ;$357.8k;$77.9k;4.6

Tucson;AZ;$368.2k;$52.9k;7

Tulsa;OK;$239.3k;$59.9k;4

Urban Honolulu;HI;$1090.2k;$63.9k;17.1

Virginia Beach-Norfolk-Newport News;VA-NC;$305.4k;$56.7k;5.4

Washington-Arlington-Alexandria;DC-VA-MD-WV;$550.1k;$80.8k;6.8

Waterloo-CedarFalls;IA;$161.3k;$53.6k;3

Wichita Falls;TX;$181.6k;$50.9k;3.6

Wichita;KS;$210.1k;$56.3k;3.7

Wilmington;NC;$414.8k;$55.8k;7.4

Winston-Salem;NC;$285.2k;$53.2k;5.4

Worcester;MA-CT;$398k;$64.5k;6.2

Yakima;WA;$341.3k;$50.9k;6.7

York-Hanover;PA;$241.1k;$57.9k;4.2

Youngstown-Warren-Boardman;OH-PA;$135.5k;$48.9k;2.8

ktxhopem3276 t1_jbok9y3 wrote

Where is Pittsburgh the 29th largest metro area?

ripgoodhomer t1_jbokzr8 wrote

People from Pittsburgh must have bribed the list maker to stay off the list. Its a pretty nice place that is still kinda affordable, at least it was when my sister left there for a new job a few years ago.

thatdude333 OP t1_jbov8dl wrote

The Metropolitan Statistical Areas listed on the chart are the ones I could match up Median Home Prices from the National Association of Realtors and Per Capita Income from the US Bureau of Economic Analysis to calculate a ratio from. Out of 384 total Metropolitan Statistical Areas, this chart shows 182 of them.

heterosis t1_jbp2r83 wrote

Newark is listed twice, once as part of NYC and once separate...

[deleted] t1_jbqiqzp wrote

[deleted]

Muffinman3571 t1_jbm3ngo wrote

I live in Utah and the rural areas are where it's really crazy. My dad lives in the city that is purely residential no business is allowed in city limits. He bought his home in 2008 for a touch under $300k. He sold it last year for $1.3 million.

I_ate_it_all t1_jbotzfv wrote

That level of growth is what we are seeing in Oceanside, which is the last coastal part of San Diego County to gentrify. It's hard to fathom, but at least if you drive inland 15 minutes the growth is only double over the same time period...

windowsfrozenshut t1_jbrp3yw wrote

Yeah, Utah is ridiculous. I was lucky and bought my house in 2018, but any median level earner here who waited until 2020 and after to try and buy is literally not able to afford anything right now. I'm not even in any of the metros listed on the chart, but my little bumfuck town is right there with them which is shocking. Double wides built in the 80's are selling for 100k at 10% interest plus 6-700 a month in lot rent, and that's the cheapest option.

Iluvteak t1_jbycz9i wrote

My god that makes me ill. Good for him but wtf is going on

[deleted] t1_jbnw00p wrote

[removed]

DawnExplosion t1_jbmnlow wrote

Spectacular! Thank you for taking the time to post this. Enjoy your award!

Wizard01475 t1_jbm68ty wrote

Where is this data from? Can we get it for 2020? 2015?

alightinthe t1_jbqms67 wrote

Yes! I want a historical perspective too- like what did this ratio look like in the 70s? 80s? 10 years ago, 5 years ago, etc.?

poopydoopylooper t1_jbn4be2 wrote

Did the math for my semi-metro area (town with a medium sized state college) and the ratio is fucking 27.9

It’s absolutely impossible to live here. No wonder I’ve been struggling to survive the last few years.

pumpjockey t1_jbmom6u wrote

Chattanooga, TN - GA

Look I get we're on the line but.....pick a godamned state

EDIT: Oh shit we aint the only ones

thatdude333 OP t1_jbnjpnq wrote

Chattanooga, TN-GA Metropolitan Statistical Area

https://censusreporter.org/profiles/31000US16860-chattanooga-tn-ga-metro-area/

whateveryouwant4321 t1_jbobw79 wrote

live in san diego and have been working remotely under our company's SF salary schedule since well before covid. i'm too extroverted to be fully remote and wish i could interact with people, but every time i look for a job here, i can't take the pay cut and still comfortably pay my mortgage without dipping into passive income. and i bought in 2016 and put 40% down.

lead_injection t1_jbocwsi wrote

San Diego underpays, and it’s by quite a lot for engineering/tech jobs. You’d probably make the same money in Arizona as SD.

itsmenobody t1_jbnajn9 wrote

Live in Irvine. This tracks.

khronz t1_jbpekr8 wrote

So much for owning property here.

esp211 t1_jbnu7kh wrote

Live in Carlsbad. Can confirm.

D3adSh0t6 t1_jbol4rl wrote

Ugh I live in San Deigo and and commute to Carlsbad. Its sad to say but Carlsbad market is better than San Diego. It's just awful overall..

Just biding my time until I can move back out east again where I can afford

rainydays2020 t1_jbm8p56 wrote

Can you tell us a bit about this sample? How/ why were this areas chosen?

thatdude333 OP t1_jbm9wf7 wrote

The Metropolitan Statistical Areas listed on the chart are the ones I could match up Median Home Prices from the National Association of Realtors and Per Capita Income from the US Bureau of Economic Analysis to calculate a ratio from.

rainydays2020 t1_jbmljoq wrote

So, just the matching data with case-wise deletion of sounds like. Would be interesting to see some descriptives: how many of the largest metropolitan areas are included? What percent of US population does this cover? Racial demographics of cities?

txa1265 t1_jbod0bn wrote

Funny looking at this - I live close to Elmira NY, and there is one major employer in the area (Corning Inc., located in ... Corning) whereas Elmira has a maximum security prison and hasn't really ever recovered since industry left and the prison economy set in.

The disparity between Elmira and the Corning/Horseheads towns that house most of the engineers/scientists/execs is ... stark. But it makes me wonder how things would compare - sure your income would increase significantly, but there are also loads of 400k+ houses (I think recent report I saw said median home price in area was close to $350k)

ghdana t1_jbr0cmo wrote

Corning also has a ton of cheap places in a good location in town, like under 150k for a place that is ok.

It's like Painted Post and Gang Mills are the expensive parts. Which of funny to me because after living in suburban hell outside of larger cities the last decade the aesthetic of PP and GM are off-putting to me. Yet they're very expensive compared to the cute historic maintained places in Corning.

ohmynards85 t1_jboexjp wrote

I wonder how many of the top 25 cheapest places to live on this list are located by factories or places that pollute a lot.

FalcoFox2112 t1_jbof41n wrote

Boy I sure know how to pick places to live. 😕

Vegas, Boise, Honolulu, Long Beach. 😓

EnHemligKonto t1_jbnhz8s wrote

I wonder if the standard deviation would add much to the data? Does it vary much between these metro areas?

A clump of data is much better described with two numbers than with one.

RobotSocks357 t1_jbo2njk wrote

I'd be curious to see this as a scatter plot as well. Sure, you lose the detail of being able to see the specific city, but for instance, Ann Arbor is not cheap yet it floats right in the middle, because income there is higher.

sourcreamus t1_jbod1la wrote

What is wrong with vero beach Florida that is has such reasonable housing ?

[deleted] t1_jbp9hxn wrote

[deleted]

lupuscapabilis t1_jbohcuy wrote

Probably hurricanes and expensive insurance

thumpngroove t1_jbophn4 wrote

My Aunt and Cousin live there, and I would, too, if was ready to retire. It’s pretty nice, and not too crazy busy. It’s just far enough away from Orlando/Space Coast and Miami/Fort Lauderdale.

afleetingmoment t1_jbpa7dn wrote

My parents have lived there since 2010. Vero has plenty of room to grow, unlike a lot of South Florida.

However, my bet is on this data being skewed not by the home costs, but by the income number. There is a small but sizable contingent of HNW individuals who call Vero home. The area is known as the Treasure Coast for a reason. The barrier island has some super exclusive communities with multi-million dollar real estate; the mainland has places where you can buy new houses for $400K+ even now.

Iluvteak t1_jbyekuy wrote

It’s a bastion of the wealthy. But also has some poor folks to service the masters. I assume the high incomes skew the data in this case.

FctFndr t1_jbovpdg wrote

SoCal.. you are way to expensive

khronz t1_jbpeo1j wrote

Gotta pay to play in the sun.

Slytherin77777 t1_jbp1g9f wrote

Have you ever been?

FctFndr t1_jbp1ltm wrote

I live and work here.. the past 35 years.

Slytherin77777 t1_jbp1syi wrote

Oh lmfao hi neighbor. I used to say “but the weather is great” and can’t even say that right now with all this RAIN

FctFndr t1_jbp4i63 wrote

true.. even parts of California have gotten epic snow. SoCal is a great place to live and work and I am glad I bought my house 20 years ago because I could not afford to buy it today with what it is worth.

When I started my career 25 years ago, I was legitimately told 'you won't necessarily make as much here, as in other places, because of the 'sunshine tax'' The fact that it is relatively beautiful year-round, you get less money!

Electrical-Song19 t1_jbr9nid wrote

are you kidding me, the rain is great! after the rain the hills look alive and refreshed, there is so much green.

captbobalou t1_jbq90q7 wrote

TIL that Helena MT ranks about the same as LA (just over 10.4), and Bozeman is off the charts, surpassing Honolulu (17.1) by a full point (18.4)

Explains a lot.

EqualityZucchini t1_jbm859t wrote

To everyone saying Seattle has a real estate bubble... Ahem.

libertarianinus t1_jbm9r8q wrote

Thanks for this. Of course the worst is california and hawaii but interesting florida has areas that are good and bad depending on the city.

Miserly_Bastard t1_jbmb9ss wrote

Florida also has a lot of retirees. That means that their cash may be coming from investments rather than earnings. However, being of low income does not mean being poor by any means.

libertarianinus t1_jbmchrw wrote

Thanks for infor, never thought of that. Great graph for future planning.

-native- t1_jbnv9qn wrote

Makes sense to only show non-Chicago IL metro towns on this list… not very comparable to LA/San Diego but what do I know

Funicularly t1_jbo7kws wrote

What are you talking about?

aycee31 t1_jbobpvx wrote

The Chicago metro area includes a very large area hence the IL-IN-WI at the end. Places like Racine and Kenosha in WI, Gary in IN are included and those places are far more affordable to buy a home than Chicago or the surrounding suburbs in IL.

Turkeydunk t1_jbox3aq wrote

Orlando housing isn’t much more expensive than the Midwest and salaries are comparable

Eudaimonics t1_jbpudv1 wrote

Not any more

Mackinnon29E t1_jbp1i50 wrote

Wow, it's great living in Fort Collins....

Wyattmae19771977 t1_jbqafx2 wrote

Agree, neighbor!

BenHur42 t1_jcd3pnk wrote

Ya fuck our housing market in the whole Front Range honestly.

UCanDoNEthing4_30sec t1_jbp7kak wrote

Great graphic. No doubt San Diego housing is not affordable to many in the city. But there are many other things that go into it. Wealth and assets are other big parts.

A lot of people in the city already own said homes, therefore, already have built up equity. They can use gains selling their homes to buy other homes.

[deleted] t1_jbq3fvq wrote

[deleted]

windowsfrozenshut t1_jbrppie wrote

Pay that thing off and live like a king!

Jace_Bror t1_jcgni30 wrote

Be nice to see more cities in MN then just Fargo on here to compare things to

[deleted] t1_jbmle25 wrote

[removed]

[deleted] t1_jbmtf60 wrote

[removed]

[deleted] t1_jbn69xd wrote

[removed]

[deleted] t1_jbnkja3 wrote

[removed]

bourbonfairy t1_jbon2oh wrote

I would like to see this sorted by average income. What city has the highest paying jobs with the lowest cost of housing?

thatdude333 OP t1_jboxop2 wrote

Here are the top 20x MSAs sorted by Per Capita Income

Per Capita Income - Median House Price - Metro Stat Area

- $136.3k - $1,577.5k - San Jose-Sunnyvale-Santa Clara, CA

- $127.4k - $621.1k - Bridgeport-Stamford-Norwalk, CT

- $123.7k - $1,230k - San Francisco-Oakland-Hayward, CA

- $118k - $802.5k - Naples-Immokalee-MarcoIsland, FL

- $95.1k - $366.8k - Sebastian-Vero Beach, FL

- $92.3k - $657.9k - Boston-Cambridge-Newton, MA-NH

- $89.6k - $759.5k - Boulder, CO

- $89.3k - $708.9k - Seattle-Tacoma-Bellevue, WA

- $85.1k - $594.3k - New York-Newark-Jersey City, NY-NJ-PA

- $85.1k - $538.5k - Newark, NJ-PA

- $83.2k - $668.1k - Barnstable Town, MA

- $80.8k - $550.1k - Washington-Arlington-Alexandria, DC-VA-MD-WV

- $78.2k - $640k - Denver-Aurora-Lakewood, CO

- $77.9k - $357.8k - Trenton, NJ

- $75.8k - $1132k - Anaheim-Santa Ana-Irvine, CA

- $75.8k - $829.1k - Los Angeles-Long Beach-Glendale, CA

- $73.5k - $550k - Miami-Fort Lauderdale-West Palm Beach, FL

- $72.6k - $857k - San Diego-Carlsbad, CA

- $72.4k - $329.5k - Philadelphia-Camden-Wilmington, PA-NJ-DE-MD

- $72k - $323.2k - Chicago-Naperville-Elgin, IL-IN-WI

And here are the bottom 20x MSAs sorted by Per Capita Income

Per Capita Income - Median House Price - Metro Stat Area

- $50.4k - $540k - Riverside-San Bernardino-Ontario, CA

- $50.3k - $195.6k - Lansing-East Lansing, MI

- $49.3k - $191.2k - Montgomery, AL

- $49.2k - $373.5k - Myrtle Beach-Conway-North Myrtle Beach,

- $49k - $207.3k - Beaumont-PortArthur, TX

- $48.9k - $135.5k - Youngstown-Warren-Boardman, OH-PA

- $48.7k - $224.1k - Springfield, MO

- $48.4k - $211.1k - Cape Girardeau, MO-IL

- $48.3k - $254k - Johnson City, TN

- $47.6k - $132.3k - Cumberland, MD-WV

- $47.3k - $218.3k - Kingsport-Bristol-Bristol, TN-VA

- $46.5k - $226.2k - Decatur, AL

- $46.4k - $207.5k - Mobile, AL

- $45.5k - $220.9k - Fayetteville, NC

- $45.2k - $280k - Ocala ,FL

- $44.5k - $205.7k - Gulfport-Biloxi-Pascagoulia, MS

- $44.1k - $244.5k - El Paso, TX

- $43.6k - $338.3k - Lakeland-WinterHaven, FL

- $43.3k - $262.8k - Bowling Green, KY

- $41.7k - $261.2k - Farmington, NM

whitepony55 t1_jbow6jc wrote

Feels bad, moving from 3 most expensive to the most expensive

rabbiskittles t1_jbpc8yq wrote

Very nice analysis!

I would be very interested to see how the number of jobs in each area looks in relation to these data (or even a silly proxy like total population). Many people say “Well don’t live in the middle of Seattle, LA, SF, or NYC then!”, but I feel like this suggestion is a bit myopic. If even 20% of those major urban workers decided to up and move to suburban/rural Illinois, my hunch is they would either quickly overwhelm the entire job market in those areas, or all the remote tech workers would quickly drive up housing prices because their Silicon Valley salary lets them offer double current rent prices and still save money.

khronz t1_jbpegkc wrote

Irvine, 14.9.....ugh, home ownership in my hometown is not possible for me and my generation.

LeadDiscovery t1_jbph5jo wrote

Holy smokes, I'm freaking rich! Now I just have to go find where I hid all that wealth...

[deleted] t1_jbpmlt6 wrote

[deleted]

Ok_Confusion_1777 t1_jbqi90p wrote

7-8 range? Median income here has gone up a lot despite what you might infer from just reading this Reddit, so the chasm isn't as awful as supposed. Not that great either though!

ParsnipPrestigious59 t1_jbqw5j4 wrote

Of course my city is one of the three cities in the second highest ratio lmao

K04free t1_jbr3bov wrote

Which city offers the best balance of quality of life vs affordability ?

[deleted] t1_jbr64yu wrote

[removed]

isunktheship t1_jbr8axf wrote

I live in the "San Diego - Carlsbad" option.. AMA

AMA stands for "Aggravated Mortgage Angst", right?

[deleted] t1_jbtb1fv wrote

[deleted]

Aerodrive160 t1_jbtij4f wrote

Did I miss it? Did not see Single town in the Washington DC metro area.

Express-Statement-90 t1_jcezur1 wrote

It’s sad that all the good places, with good paying jobs and a modern society are expensive. The worst places are cheaper and are run by republicans.

captainpicard6912 t1_jbq3v5w wrote

Cue all the whining about how it's "not fair" that larger/more desirable metro areas are more expensive. Even though that's been the case since...forever.

AdamantForeskin t1_jbo7a6u wrote

Not to be snarky, but I bet if you gathered data on how desirable each of these places are to live, the R-squared would be 1, or so close to 1 so as to effectively be 1

thatdude333 OP t1_jbohm0b wrote

Desirability is highly subjective.

I live in the Syracuse, NY MSA which has a pretty low ratio (3.4) and enjoy living here - Mild summers, actual winters (3 ski resorts close by), easy driving distance to the Adirondacks & Catskills, no traffic, all my friends are within an hour or so drive, $270k 2500sqft house on 3 acres 20 minutes from work.

From other threads on housing costs, I see tons of comments from Redditors that "can't live" in areas outside NYC, Boston, DC, Seattle, SF, LA, etc. because they value urban living the most.

To each their own, but my point is, different people value different things.

omarmctrigger t1_jbm8fde wrote

I’m calling b.s. on that Nashville score.

thatdude333 OP t1_jbm8ugy wrote

Take it up with the National Association of Realtors & US Bureau of Economic Analysis

Music_City_Madman t1_jbmmbr2 wrote

Lol i know, right? $70K per capita? The median HHI in Davidson County is like $69K. I’d wager most people in Nashville area are earning $45-$65K tops. Wages here suck.

alwaysmyfault t1_jbms7zu wrote

Kind of a weird label for Fargo.

It's labeled as "Fargo ND-MN" (It's at the 4.6 mark)

Fargo is in ND, not MN.

smillersmalls t1_jbmwu4p wrote

These are MSAs, OP didn’t make them up. Part of the Fargo metro area is in MN.

[deleted] t1_jblvvml wrote

[deleted]

thatdude333 OP t1_jblwhz5 wrote

Boston-Cambridge-Newton, MA-NH Metropolitan Statistical Area

https://censusreporter.org/profiles/31000US14460-boston-cambridge-newton-ma-nh-metro-area/

DM-me-ur-tits-plz- t1_jbm11zo wrote

Illinois represent! Seriously, I moved out to California for a big tech job after college and my buddy who skipped college to become a mechanic is now looking to buy a house years ahead of me. I make more than double his salary.

This country can feel like different worlds sometimes.