Submitted by giteam t3_ym0yjv in dataisbeautiful

Comments

cerebralsexer t1_iv26x4u wrote

And easier to buy than actual product I think

[deleted] t1_iv1y9b3 wrote

[deleted]

685327592 t1_iv1znss wrote

When you buy an index you're buying stocks with no research into the underlying companies. This only works if the market is working efficiently and prices represent all knowledge available to the market. If most money is invested passively then the market can't work efficiently anymore because most of the buying and selling pressure is divorced from the underlying fundamentals of a company. This allows active managers to buy or sell stocks that are priced incorrectly in order to beat the market.

giteam OP t1_iv16vrd wrote

rashaniquah t1_iv2z8uu wrote

Marketcap != popular. Should've done with trading volume instead.

Ipsos_Logos t1_iv3719y wrote

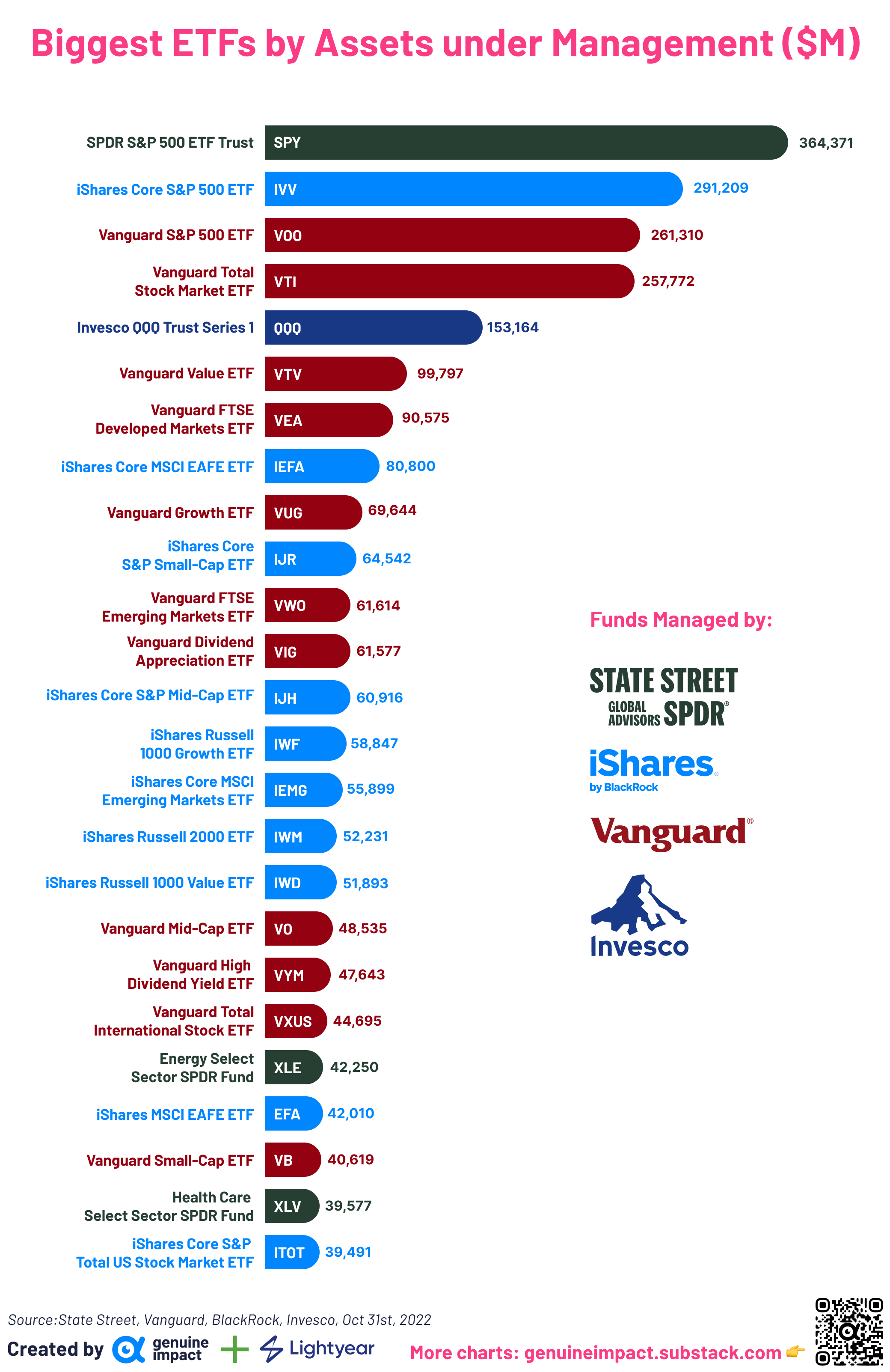

Some people say look at small caps to lead the recovery… not sure if that’s true. Thanks for this list, didn’t know about many of these.

monstrorph t1_iv40lff wrote

This allows active managers

Mountain-Lecture-320 t1_iv18b89 wrote

🤮 vanguard

It's a shame none of the fossil fuel and defense free ETFs make the cut yet.

jonnysteps t1_iv1f3p2 wrote

I'm curious. Why 🤮 for vanguard?

Mountain-Lecture-320 t1_iv1p5si wrote

Their US PAC donations and leadership. They're like cartoon bad guy sometimes, and their peers listed here are tame or even decent by comparison.

Maakus t1_iv1pb3b wrote

Vanguard is a successful fund however I think their issue with the fund is that they contribute to defense and fossil fuel stocks that one could argue are not acceptable/sustainable for the future of mankind.

scheav t1_iv2xete wrote

I'll make sure to buy some extra Vanguard funds containing defense and fossil fuel stocks to make up for your boycott. Maybe they should come up with a fund containing only those.

[deleted] t1_iv1rbbp wrote

[deleted]

Mountain-Lecture-320 t1_iv1wlpd wrote

By using a royal we, do you mean to assert that consumer demand is the sole market force that perpetuates the existence of oil and guns?

[deleted] t1_iv2un28 wrote

[deleted]

BigDataBoy t1_iv2f9n8 wrote

Think you need to watch this my guy:

If we undervalue companies you don’t like, someone else has a significantly higher expected return by investing in them. Thus, the marketplace is still efficient. Thematic etfs are just a way to make Wall Street richer by charging higher ER.

Mountain-Lecture-320 t1_iv2i6pe wrote

He did not make the same assertions as you have. None of what he said is surprising to me nor contrary to my existing knowledge on the topic.

I recognize he points to an error in my "fossil fuel and defense free" statement, that it rarely/never is so cut and dry.

Being flatly unwilling to trade in blood money is a fundamental values-based approach that requires no economic justification.

Eiknarf95 t1_iv1lmtv wrote

Invesco has a Solar ETF ($TAN), I’m not sure how QQQ is on clean energy and defense free though

Mountain-Lecture-320 t1_iv1obvh wrote

SPDR has $SPYX, also not listed. QQQ doesn't seem to have energy or defense represented in any great proportions, so my prior assertion about fossil fuels and defense may not be right.

AugmentedLurker t1_iv8wyk5 wrote

>defense free

Why would you not invest in defense during some of the absolute largest surges in defense spending in decades...

685327592 t1_iv1aw5t wrote

ETFs have become so popular because there is mountains of evidence that no active manager can actually consistently beat them. HOWEVER as passive investments take over more of the market it actually does create arbitrage opportunities that active management can exploit.