Comments

VisualMod t1_jaa7eso wrote

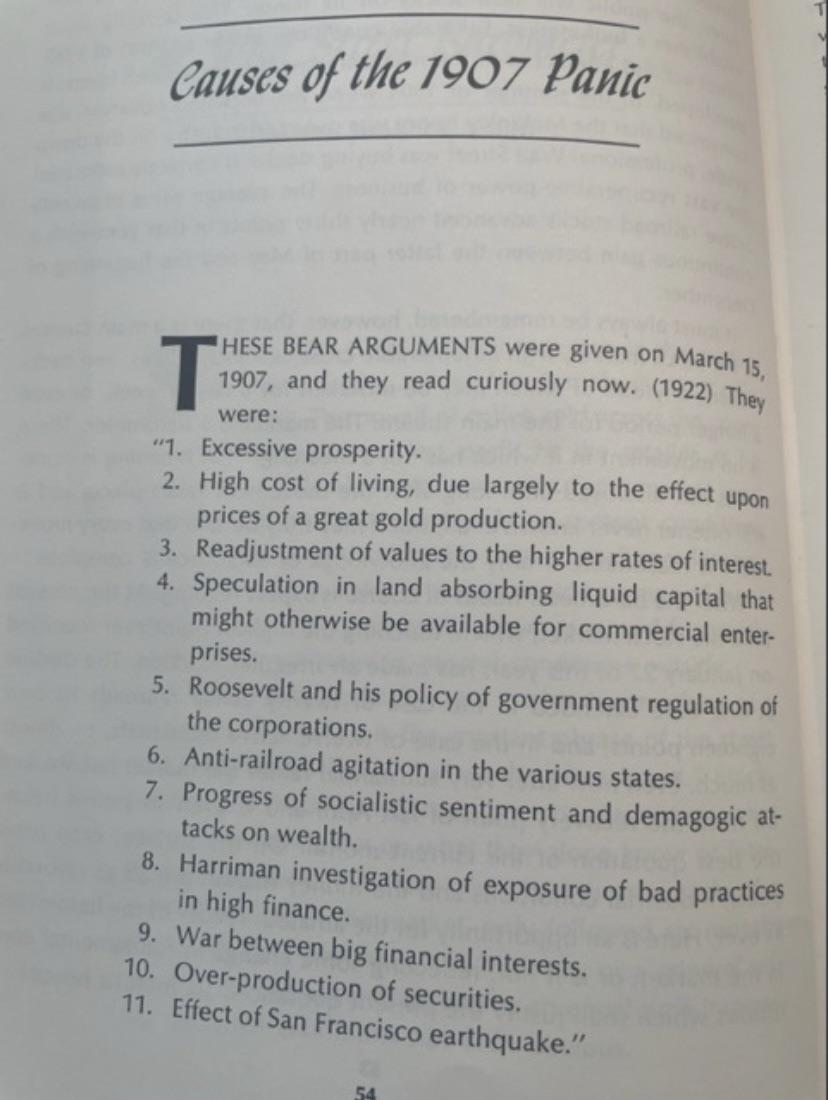

- Excessive prosperity is a cause of the 1907 Panic because it results in people becoming overextended and taking on too much debt. This can lead to defaults and foreclosures, which can trigger a financial crisis.

- High cost of living is a cause of the 1907 Panic because it increases the costs of goods and services, which makes it more difficult for consumers to make ends meet. This can lead to decreased spending, which can hurt businesses and trigger a recession.

- Readjustment of values to higher rates of interest is a cause of the 1907 Panic because it makes borrowing more expensive, which can discourage investment and consumption spending. This can lead to economic contraction and job losses, setting off a downward spiral in economic activity

CreepingFog OP t1_jaa7f76 wrote

There is nothing new under the sun, there is always some shit happening in the world and yet the US stock market has always persevered.

CreepingFog OP t1_jaa7iy7 wrote

RunningForIt t1_jaa7ph7 wrote

1907 - “High cost of living”

100 years later - “high cost of living”

100 years from now - “high cost of living”

BUDDHA_LAUGHING t1_jaa7z55 wrote

Every hundred years all new people.

[deleted] t1_jaa82wk wrote

[removed]

potatersupreme t1_jaa8m2v wrote

Talking shit about the wealthy!

Corruption in high finance

High finance fighting high finance

Over producing of securities!! Phantom shares back then too!!

islayscotchwhiskey t1_jaa9416 wrote

It works until it doesn’t. The US is a young country.

NOT_MartinShkreli t1_jaa9dy5 wrote

Or swap with turkey earthquake …

chikken_hawk t1_jaa9fqr wrote

Almost all of the above

NOT_MartinShkreli t1_jaa9gmr wrote

The bot is right. Top is in. Currently all of these hold true in todays times

[deleted] t1_jaa9y3n wrote

windsock1 t1_jaaaqjf wrote

bUT wE HaVe TOolS!

Malevin87 t1_jaaav9j wrote

In the past China is weak. Now China is extremely strong and wealthy to challenge US in infrastructure and tech. China may still be behind US in tech, but they are ahead in infrastructure. America have been complacent for far too long as a world power and have to accept that the world have 3 world powers now. US, China and South East Asia countries combined.

Kitten_Team_Six t1_jaabeyl wrote

Excessive prosperity was owning more than one light bulb

CreepingFog OP t1_jaabuhq wrote

yet many chinese companies wants to be listed on the US markets and not vice versa?

KarmicComic12334 t1_jaac43w wrote

8 stands out in its absence. After the 08 crash they even made movies to warn people who weren't reading the financials at the time. If bad practices are poisoning the market, anyone who reveals the weakness will be cut off and left to die while those who praise the beauty of the emperor's clothes until the bottom falls through will get bailed out.

Disastrous_Excuse_66 t1_jaacce6 wrote

So your saying we need the big quake to occur to tip the dominoes?

Warlover1 t1_jaaccyh wrote

What the book says is when the poor make money the economy crashes.

CreepingFog OP t1_jaacviq wrote

And when the poor spend money the economy blooms.

WarrenBuffering t1_jaacx6h wrote

Wow. This sub is hella 🌈🐻 right now

SaltyShawarma t1_jaaedwc wrote

I don't care. I'm going to downvote it every fucking time. Fucking robots...

CreepingFog OP t1_jaael0n wrote

I think you misunderstood the post then because I’m implying that these bearish arguments were made over a hundred years ago but they were just noise.

Washout22 t1_jaaf9us wrote

This was my take away. The turkey quake was just a warning!

Washout22 t1_jaafivm wrote

China is not as strong as many think.

Their demographics are terrible, and they have a huge debt and currency problem while the usd is getting stronger.

Bad for all other currencies.

NagatoKami t1_jaafp5y wrote

With the only difference that back then money had some value. Now it's just another Ponzi scheme. We are good as long as the US is able to force those investments in (bigger loans to pay the old ones) until we aren't. Hope I'm alive to see it when it's over and what the bankers will come up with next.

SageMaverick t1_jaagj5e wrote

What a dumb comment. South East Asia unite

Royal-Application708 t1_jaagqqm wrote

Well #5 is not an issue at all. Everything is fucking deregulated!! Corporate greed and extreme profits is the real problem. That and the fact that corporations (with their unlimited campaign contributions) own the world and government.

_foldLeft t1_jaahasp wrote

San Francisco could use another earthquake tbh

CreepingFog OP t1_jaahvko wrote

And how does corporate greed and extreme profits hurt stocks? Do you know which sub you are in?

Zaros262 t1_jaaidtr wrote

Sure, but there are a lot of 🌈🐻 in the comments

CreepingFog OP t1_jaaisry wrote

Lol agreed, they now have to get over the fact that they are not so original and unique as they thought they were.

runsanditspaidfor t1_jaajai8 wrote

I’m not convinced the majority of America is experiencing excessive prosperity right now.

EatinTendieS t1_jaak9a7 wrote

All you g 🐻🧸keep begging

WolfPackWSB t1_jaake4y wrote

Yes the Earthquake is on the way!!

monk8919 t1_jaal755 wrote

This is too real for this sub wtf? Thought I was looking at r/investing for a second

Malevin87 t1_jaam9x6 wrote

Its just that America is not as strong as many Americans think they are. In fact in Asia, many would rather welcome Chinese than Americans as Americans no longer have the wealth. They also rather choose Chinese companies to build infrastructure for them. Not because its cheap, but its quality as well. America have nothing to show for except military. This is why their common folks are suffering.

Malevin87 t1_jaamdt0 wrote

South East Asia will unite when facing a stronger common enemy.

Fluffy-Ad1712 t1_jaamf5s wrote

Is this Bruner’s book?

Malevin87 t1_jaamlom wrote

Because US market have the liquidity. Thats all.

Cindylou3who t1_jaan4xi wrote

I got 12 eggs in fridge, feel pretty prosperous.

CreepingFog OP t1_jaan5me wrote

No, “A treasury of wall street wisdom”

RedditsFullofShit t1_jaangzf wrote

Common folks have always suffered everywhere.

It’s not like 50 years ago there wasn’t poverty in the US. The poverty has always been there. And in capitalism there will always be those who suffer.

The US is so advanced in warfare that economics don’t really matter. If it really came down to it the US would go to war and win.

bluemasonjar t1_jaao78l wrote

Roosevelt out here in these streets

Washout22 t1_jaao9ro wrote

North America has plenty of food and other natural resources. Lots of navigable rivers, and better demographics.

We have more purchasing power per capita.

China is in for a world of hurt as the USA and West decouples.

Globalization helped China immensely. They're now trying to pivot to a service based economy with half the population in poverty.

I have no issue with China, but they're not in a good spot

GoogleOfficial t1_jaaplss wrote

Kids sat around the house and didn’t go to work until age 7! Spoiled brats. Previous generations worked the land at 3.

SweetLobsterBabies t1_jaaqire wrote

Doomers gonna doom

Just so happens they all jumped on the GME/NFT bandwagon and lost all their money.

Must've been the economy's fault, it's definitely gonna crash

PaulR504 t1_jaaquiz wrote

The cycle repeats as designed by the real owners of this country. Plebs need to be put in their place every so often.

percentofcharges t1_jaardhd wrote

Roosevelt still fucking shit up

WarrenBuffering t1_jaareim wrote

Oh sure. We're talking different time horizons. I see WSB I assume FDs

hahaa242 t1_jaaryq0 wrote

“History never repeats itself, but it does often rhyme.”

yamazaki25 t1_jaat2e2 wrote

Doesn’t China have a major dam failure that kills tens of thousands and displaces a quarter million people like every other week due to the lack of engineering oversight and use of poor construction materials?

hendysae34 t1_jaatap7 wrote

The players life the game of Life decide the route they want to take and then move their vehicle tokens around the gameboard as they go from Start to Retirement. Who is going to have a lot of money and success?

skippy_smooth t1_jaau2ds wrote

San Francisco earthquake priced in.

tigerkingsam t1_jaauq1s wrote

You only get rid of the sticky inflation we have now through high unemployment rates and decimation of home prices and stock valuations. Bernard Arnault, owner of LVMH being the richest man in the World should tell you consumption has gone off the rails into excess. Where the monthly mortgage for a 600k home with 20% down is 4k. We will see the market collapse like in the past when everyone realizes how much pain we have to go through to overcome sticky inflation. JPow will be the most hated man in the World but he will undoubtly give the chemo therapy that the market needs to live. Buls will be in breadlines EOY.

AutoModerator t1_jaauq3n wrote

Eat my dongus you fuckin nerd.

I am a bot, and this action was performed automatically. Please contact the moderators of this subreddit if you have any questions or concerns.

realmastodon2 t1_jaavabg wrote

100 years from now - sex slaves for Robots.

Painty_The_Pirate t1_jaax1fo wrote

No it actually says when the rich make their money illiquid in real estate, you can bump into issues

Sad-Proposal5404 t1_jaax838 wrote

Silly me, I assumed the sex robots we create would always be more on the receiving end. It's really scary to think that as quick as a hundred years, theyll be making their pompous human creators pay dearly

czarnick123 t1_jaaxncd wrote

It's vague doom and gloom. It's perfect for WSB or any mainstream investing clickbait venue

[deleted] t1_jaaxuf5 wrote

Painty_The_Pirate t1_jaayfvt wrote

Nvm poor people definitely play a role, I just had ChatGPT estimate the total amount of invested capital in the US that's in retirement accounts...it came up with ~4 trillion in 2019 just for households headed by someone 55-64. That's 10% of the S&P's total market cap TODAY (still slightly higher than 2019).

Sisboombah74 t1_jaayixr wrote

Are you honestly trying to compare the complexity of todays economy with one from 110 years ago?

realmastodon2 t1_jaazvzk wrote

The rise of Fisto.

USA_RedWhiteBlue1776 t1_jaazywq wrote

Same game different time.

Slow-Bookkeeper7486 t1_jab0578 wrote

haha. bears were braindead even in 1907

Fitness4All26 t1_jab0l8r wrote

This is all wrong

_khanrad t1_jab5ft1 wrote

Some walnuts and an orange for Christmas, recession confirmed.

[deleted] t1_jab9ees wrote

Malevin87 t1_jab9waz wrote

America have dams failure too with one that happened in 2020. I been to both America and China. The infrastructure in the US are in such a bad shape compare to China. I think Americans should not be a frog in the well. Travel more and you realise how good China infrastructure is. Even their 2nd tier and 3rd tier cities are better than New York. The only people who thinks America infrastructure are better than China are the ones who do not travel. Even Japan and South Korea and Singapore are ahead of America.

Equivalent_Trifle738 t1_jabfatg wrote

Replace gold rush with crypto mining

nikchi t1_jabfwbw wrote

This guy really thinking chatgpt has accurate data and isn't just Markov chaining a guessed bullshit answer in a convincing format.

We're doomed lol.

V6TransAM t1_jabg19a wrote

Roosevelt was a two faced lying douche of a politician. And leave my boy Harriman out of it, they never got a damned thing on him. In fact everything he said came to pass years later once again. Dumbass government.

DawdenFawdeunt t1_jabg335 wrote

History repeats itself

Invest0rnoob1 t1_jabh8t9 wrote

2008 and 2001 didn’t work out so now we’re 1907.

yamazaki25 t1_jabi5st wrote

It’s easy to build things in blood. And since China does its best to cover up any and every single disaster that occurs, the world will never know how many people have truly died due to the lack of regulation. I’d take my chances on a place that doesn’t have to cover up disasters, even if it has less “stuff.” I’ve been to several countries. I know what the differences in infrastructure can look like. But there is a reason why NYC is the finance capital of the world. And there is a reason why LA is essentially the cultural capital of the world. People don’t move from LA or NY to China to find a better, safer, more fulfilling life. They do the opposite, in fact. You could build your streets with diamonds and gold and I’d still never take my chances entering the country of China.

SpiritualTwo5256 t1_jabiwjv wrote

Every time people panic, it causes problems. The markets are causing messes. Or more accurately enabling abusers to take money out of manufactured crisis.

TopXKiller t1_jabjomt wrote

Enjoy your Solar Storm EMP Millennials

TopXKiller t1_jabk0zd wrote

100 years from now - Minimum wage still $7.25

ChampionshipLow8541 t1_jabk3zy wrote

Progress of socialistic sentiment? How does that relate to today? It’s the opposite: continued widening of the wealth gap. 5 million kids in the US that go hungry. People can’t afford health care. 🤦♂️

TopXKiller t1_jabk6u6 wrote

Circle my dude. Even a square can be used as a wheel.

TopXKiller t1_jabka7j wrote

You will be assimilated. Resistance is futile. -ChatGPT

Painty_The_Pirate t1_jabkumr wrote

It cited its sources, is it known to lie about those I didn’t check them

[deleted] t1_jabo49s wrote

[removed]

Zegano t1_jabo4pk wrote

Yes, it frequently cites sources that don't actually exist.

uZeAsDiReCtEd t1_jabqdb9 wrote

But I’m poor and not making any money? What am I not being told

BullyBumble t1_jabr75x wrote

The point was #5 isn’t happening so it’s not a prob for stocks…

anon6966669 t1_jabsix8 wrote

massive san francisco earthquake confirmed

Adept_Particular_274 t1_jabu4zf wrote

Money itself is a ponzi scheme, the gold standard was fake as well, what gives gold value? It is a shiny metal that looks nice I guess. You could substitute anything that is rare for gold. Gold is worthless and has been for a long time. Money has value because you can buy things with it. The US economy is not a Ponzi scheme. Ponzi schemes are run by people who steal money. The government can create money that has value any time they want and they do an excellent job managing the money supply.

The US has the strongest most powerful economy in the world because of the Federal Reserve and because we have the smartest workers in the world working here. That will not change for decades. The US rules the world and we have no competition and it is not even close.

cletus_ t1_jabzwrf wrote

Bad practices in high finance? 😂

cletus_ t1_jabzxzn wrote

cletus_ t1_jac0159 wrote

Jokes on them, I love bread.

CreepingFog OP t1_jac11m0 wrote

I love bear porn, always some new theory about how we are all doomed but it never actually happens 😂

BiigIfTrue1492 t1_jacbq6m wrote

Dumb bears😂😂😂

Updogfoodtruck t1_jaccu12 wrote

And can you believe that people are talking shit about the railroads? East Palestine better get their act together or this market is gonna crash, say nice things about norfolk southern, or we are doomed!

egotripping7o t1_jacd7zo wrote

Loose_Screw_ t1_jacdm06 wrote

Yeah ChatGPT often fails at even basic arithmetic for this reason. It can only guess likely continuations based on similar sentences, it isn't deterministic.

grannie23 t1_jacds5w wrote

When was San Francisco Covid?

purple_hamster66 t1_jacgpxp wrote

This doesn’t apply to today’s situation:

- corporations are swimming in excessive profits; largely, regulation has not affected their ability to swindle consumers

- unemployment is really low today

- only 10-15% (of the US population) are experiencing a “high cost of living” relative to home prices. Basically, the young (18-25) and the poor.

- renewable energy is making energy way cheaper.

- WFH (Work From Home) is cheaper for workers.

Shuteye_491 t1_jachzc7 wrote

We did crash after COVID tho 🤔

dog3_10 t1_jackmdn wrote

I love that these were written in 1922, I think that is a good comparison to where we are today and where we are headed

TherabbitTrix0 t1_jacl1ja wrote

Capitalists gonna capital

lrrc49 t1_jacll67 wrote

The 1% have been worried about the same things for over a century!

mrnoonan81 t1_jaclpon wrote

Not that it's you making the argument, but you can't make money illiquid.

ImNoAlbertFeinstein t1_jacqapq wrote

plot twist

ImNoAlbertFeinstein t1_jacqmam wrote

the JPow-5000 is said to be particularly rough on some assholes.

wickedmen030 t1_jacra2a wrote

Just like normal people do

Sad-Proposal5404 t1_jacrzld wrote

I can't even imagine the asshole technology of 100 years in the future. Lucky for Gen c^2

WesternBackground47 t1_jact531 wrote

You could be forgetting:

Inflation

50-60 year global unemployment rates

Trillions of stimulus pumped into system

Trillions of debt unable to withstand high interest rates

Central bank policy focused on curbing inflation no matter the cost to the economy

Corporate profit at all time highs yet corporations dont pay taxes to local governments

90 year old president who cant string a sentence together

Opposition party seems to be filled with a bunch of lunatics as front runners

Potential for nuclear war

CHINA

CLIMATE

Valkanaa t1_jacw61y wrote

San Francisco has a pretty serious homeless problem now and you want to make more of them?

PIK_Toggle t1_jacxn2v wrote

Well, this was in an era before the Federal Reserve existed, and it is why we have a Federal Reserve Bank.

While it's always fun to fund historical parallels, it's all a bit of a stretch.

You'd be better off looking at the Spanish Flu of 1918 for a comp.

Johnathonathon t1_jad0abn wrote

Apparently the railroad bubble was huge! I can't remember how many miles of excess track was being built but I thinks something like only 40% were routes popular enough to be profitable. The others were railroads to nowhere

Odd_Explanation3246 t1_jad0vca wrote

All of the above points are irrelevant…fed was the main reason why a recession turned into a depression..ben bernake, former fed chairman and whose phd was on analysis of great depression is the only fed person to ever accept that the fed caused the great depression. (https://www.federalreservehistory.org/essays/great-depression)

CreepingFog OP t1_jad3vt5 wrote

Yeah, they constructed railroads that led from nowhere to nowhere. They did so not because of a profitable market opportunity, but due to numerous investors driven by FOMO who were handing them their money. And since these companies were not generating any revenue and relied solely on investor capital, the bubble eventually popped as you said. Very similar to what we have been seeing with the tech industry recently.

throwawaytorn2345 t1_jad778v wrote

Nonono bad economy is them snowflake millennials fault for spending so much, only MAGA GOD FEARING BLESSED BOOMER spending leads to good economy. Guy on FOX said it and he is right.

AutoModerator t1_jad77an wrote

4288 UNITS! BOOM!

I am a bot, and this action was performed automatically. Please contact the moderators of this subreddit if you have any questions or concerns.

cmsutton1983 t1_jad8h24 wrote

- No Fed

computermademedoit t1_jad9rh4 wrote

this sub has a no politics allowed rule, cuck

​

take your political fever dreams to r/politics

ricosuave79 t1_jadlzt7 wrote

History doesn't repeat, but it often rhymes.

Warlover1 t1_jadp97l wrote

Get another credit card and max that puppy

uZeAsDiReCtEd t1_jadvkks wrote

I’d have to ask my mom first

ShoppingbagKellz t1_jadwz2n wrote

Lol demagogic attack on wealth

[deleted] t1_jadx0sd wrote

[deleted]

CreepingFog OP t1_jae0yia wrote

Yep I shamelessly stole it from there 😈

But it wasn’t to get internet points, I just wanted for people here to see that their bearish arguments are nothing new

[deleted] t1_jae3mva wrote

[deleted]

CreepingFog OP t1_jae5suk wrote

Haha who is Jeff btw? I’ve only seen renmac on twitter :)

[deleted] t1_jae8eth wrote

[deleted]

CreepingFog OP t1_jae8s3e wrote

Ah okay thanks for the answer. Interesting, I’ll read more about him, only seen him pop up on my feed

Superb-Ad3945 t1_jaeb63k wrote

Now I am going to up vote every time and occasionally say “good bot”. Cuz I thought that is how we train it?

Superb-Ad3945 t1_jaeb6fa wrote

Now I am going to up vote every time and occasionally say “good bot”. Cuz I thought that is how we train it?

dkrich t1_jaeb90b wrote

How is the bank contagion from the failed attempt to corner the copper market not make this list? If you read confessions of a stock operator he paints a very clear portrait that basically says there was no liquidity after everyone got margin called

Superb-Ad3945 t1_jaebwdk wrote

Like it 2000. I saw some dd where the events of the economy match every 70-80 years. As that is how long it takes for people to die and lessons learned to be lost. Perhaps people live longer now. I think 2008 was not a black swan event but really just getting back to long term average. But the governments would not allow it. So here we are. And the government might not get a say this time

CreepingFog OP t1_jaee715 wrote

I was wondering that too. And the book is called reminiscences* of a stock operator :p it’s a great book!

CreepingFog OP t1_jaeef0v wrote

Yep, I subscribe to that theory!

Autoboat t1_jaeewyd wrote

lol wut. The US economy is objectively more regulated than it ever has been before. The federal government creates literally thousands of regulations every single year and has been doing so for decades.

https://sgp.fas.org/crs/misc/R43056.pdf

https://www.quantgov.org/visualizations-of-rd-32

https://www.thepolicycircle.org/brief/government-regulation/

https://regulatorystudies.columbian.gwu.edu/brief-history-regulation-and-deregulation

But please feel free to provide any counter-evidence that things are somehow becoming less regulated overall.

VisualMod t1_jaa7e24 wrote